In a previous post I review the ESG code of the Malta Gaming Authority. Crucial in this document, and any ESG strategy, is the materiality assessment.

In short, something is ‘material’ when it’s significant. A materiality assessment looks at what aspects of an organisation’s context are significant for its existence.

I wanted to better understand what a materiality assessment is and what the differences are between the assessments of different igaming companies. This is a crucial aspect when wanting to rate the most sustainable online casino companies. Therefore I decided to dive into the topic and look at the materiality assessment of the MGA ESG code compared to the materiality assessment of 5 igaming operators.

TL;DR

- Materiality assessment is an important tool for understanding, planning and executing ESG strategy (skip to the why, what or how part)

- It relates the most material (significant) topics according to stakeholders and the business and relevance and priority can be visualised in a matrix.

- There are significant differences between the materiality assessment of the MGA and 5 operators (skip to the findings and conclusions section of this article)

- BWC envisions a roadmap to an industry-standard materiality assessment (skip to our vision)

- The materiality matrices of the MGA and 5 iGaming companies can be seen in this post.

- In this sheet you can review the compiled data and compare the different topics and ratings.

In the ever-evolving landscape of corporate social responsibility, the term ‘materiality assessment’ has become a linchpin for businesses intent on navigating the complex interplay of environmental, social, and governance (ESG) factors. The materiality assessment is a strategic tool used to identify and prioritise the ESG issues that are critical to an organisation’s business strategy and its stakeholders’ interests.

For the iGaming industry, where the impact of decisions can reverberate through social, economic, and environmental channels, understanding and applying materiality assessments is not just prudent; it’s imperative. These assessments help companies like those in the iGaming sector to focus their efforts on what matters, ensuring they address the pressing challenges and opportunities head-on.

At Better World Casinos (BWC), we recognize the importance of these assessments for forming strategies that align with our core values of transparency and integrity. In the spirit of these values, this article will provide a primer on the concept of materiality assessments and has a look at different materiality assessments.

In this article:

- About the materiality assessment

- Analysing and comparing the Materiality Assessment presented by the MGA in their ESG code and with those from 5 operators (aka licence holders)

- What I learned and what’s next?

- Roadmap to industry standard materiality assessment

As BWC charts a course toward not only reviewing but also setting new standards in the iGaming world, we commit to not just observing but actively participating in this vital process. In the future, BWC will undertake its own materiality assessment, setting a benchmark for ESG performance in the industry and guiding players to make informed choices about where they game.

Join us as we unpack the methodology, analyse data from leading gaming authorities and operators, and demonstrate how materiality assessments are shaping the future of iGaming, one ethical decision at a time.

What is a Materiality Assessment?

A materiality assessment is a systematic approach used by organisations to identify, refine, and prioritise sustainability issues that are of significant impact to the business and its stakeholders. This process goes beyond the financial bottom line, incorporating the principles of single, double, and triple materiality to gauge the full spectrum of a company’s influence on the economy, the environment, and society.

- Single materiality refers to the financial implications of sustainability issues on the organisation.

- Double materiality considers the organisation’s impact on the economy, environment, and society, alongside the financial aspect.

- Triple materiality expands this further by integrating the interdependencies between these factors.

The objective of conducting a materiality assessment is multifaceted:

- Strategic Alignment: To ensure that a company’s sustainability efforts are aligned with its business strategy and stakeholder expectations.

- Risk Management: To identify potential risks and opportunities that could affect long-term viability and success.

- Stakeholder Engagement: To facilitate a dialogue with stakeholders, incorporating their insights into the company’s sustainability strategy.

- Reporting and Disclosure: To inform transparent reporting and disclosure, guiding investment decisions and improving stakeholder relations.

The output of a materiality assessment typically takes the form of a materiality matrix – a visual representation that plots the importance of various issues against their level of concern to stakeholders against the impact on the business.

In the iGaming industry, where the ramifications of corporate actions are wide-reaching, a materiality assessment becomes a crucial instrument in steering the ethical compass of a company. It’s an approach that BWC not only endorses but also plans to adopt, ensuring that we hold ourselves and the industry to the highest standards of ESG performance.

The Importance of Materiality Assessments in iGaming

Materiality assessments serve as a strategic tool that enables iGaming companies to navigate the complex business environment more effectively. They are about how to integrate materiality topics into the core business strategy and operations in the most efficient and value-driven way.

Enhanced Focus and Efficiency: The materiality topics span a broad spectrum of issues, from environmental impact of data centers to anti-money laundering, and from player protection to diversity and inclusion topics. Materiality assessments help businesses to identify which issues are most critical, allowing for a focused approach that prioritises key areas and allocates resources where they’re needed most.

Proactive Compliance: The dynamic nature of regulatory frameworks means that new requirements can emerge rapidly. Materiality assessments can provide foresight, enabling companies to anticipate and prepare for upcoming regulations, thus maintaining uninterrupted operations and avoiding potential sanctions.

Deep Integration of materiality topics: Beyond adhering to regulations, materiality assessments encourage a deeper integration of materiality topics into the company culture and values. This holistic approach ensures that every level of the organisation understands and aligns with regulatory expectations, embedding materiality into daily operations.

Building Stakeholder Trust: Stakeholders today demand transparency and ethical conduct. Materiality assessments help businesses to demonstrate their commitment to sustainability, which can strengthen stakeholder trust and cement the company’s reputation as a responsible operator.

Strategic Alignment: Finally, these assessments ensure that ESG efforts are not just reactive measures but are strategically aligned with the company’s long-term goals, supporting sustainable business growth and the overall mission.

For BWC, materiality assessments are crucial for assessing how iGaming companies identify and prioritise their ESG tasks. These assessments form the backbone of our review process, ensuring that the operators we recommend are not just meeting the baseline requirements but are setting the standard for best practices in compliance and beyond.

Methodology of Materiality Assessments

A materiality assessment follows a structured approach, designed to ensure that a company’s sustainability efforts are both effective and strategically aligned. Here’s a step-by-step breakdown of how the process typically unfolds:

- Issue Identification: The first step is to create an extensive list of ESG issues that could potentially impact the business and its stakeholders. This can involve reviewing industry reports, sustainability frameworks, and engaging in initial stakeholder consultations.

- Stakeholder Engagement: Next, the company identifies its key stakeholders – which could include customers, employees, regulators, and investors – and engages with them to understand their concerns and expectations. This process can take the form of surveys, interviews, workshops, and public consultations.

- Impact Analysis: Concurrently, the company assesses the potential impact of each ESG issue on its operations and strategy. This involves looking at both the risks and opportunities presented by each issue and considering both current and future scenarios.

- Prioritisation: With the data gathered, the company then prioritises the issues based on their significance to stakeholders and their impact on the business. This is often visualised in a materiality matrix, with one axis representing the level of stakeholder concern and the other the impact on the business.

- Validation: The preliminary results of the assessment are typically reviewed and validated by company leadership to ensure alignment with strategic objectives and operational realities.

- Integration and Action: The final step is to integrate the findings into the company’s strategy and operations. This can result in adjustments to policies, the setting of specific goals, and the allocation of resources to address the most material issues.

For iGaming companies, this methodology is a pathway to operational excellence and sector leadership. By systematically identifying and prioritising ESG issues, companies can make informed decisions that drive positive change and resonate with all their stakeholders.

At BWC, we leverage the insights from these materiality assessments to guide our reviews, ensuring that the iGaming companies we evaluate and recommend are truly aligned with the principles of sustainability and social responsibility.

Topic Selection and Prioritising

In materiality assessments for the iGaming industry, the process of topic selection and prioritisation is integral for identifying and addressing key ESG issues. This involves:

- Industry Relevance: Selecting topics pertinent to the iGaming industry, such as responsible gambling, data security, and environmental impacts of digital infrastructure.

- Stakeholder Concerns: Incorporating the interests of diverse stakeholders, from players to advocacy groups, to identify relevant issues.

- Emerging Trends: Keeping up-to-date with sustainability trends, technological advancements, and shifts in public sentiment.

- Business Impact: Considering topics’ potential risks and opportunities for the business, including regulatory fines and sustainable practices.

- Global and Local Considerations: Balancing international practices with regional requirements and cultural sensitivities.

- Assessment and Ranking: Evaluating topics based on stakeholder importance and business impact. This includes stakeholder feedback analysis and risk-opportunity assessment.

- Materiality Matrix: Utilising a materiality matrix to visually represent the significance of issues, aiding in clear identification of key areas.

- Dynamic Prioritisation: Regularly reviewing and updating the assessment to reflect changing stakeholder expectations and business contexts.

- Strategic Alignment: Guiding strategic decisions to align business practices with the most material ESG issues.

For Better World Casinos, understanding the selection and prioritisation process in iGaming companies’ materiality assessments is crucial to evaluate ESG strategy and commitment to responsible and sustainable practices.

Stakeholder Involvement in Materiality Assessments

The involvement of stakeholders is a fundamental component of the materiality assessment process. It ensures that the assessment considers a diverse range of perspectives and aligns with the needs and expectations of those impacted by the company’s operations. Here’s how stakeholders are typically involved:

- Identifying Stakeholders: The process begins by identifying who the stakeholders are. In the iGaming industry, this can include players, employees, suppliers, regulators, investors, local communities, and advocacy groups.

- Engagement Methods: Various methods are used to engage with these stakeholders. This might involve surveys, focus groups, interviews, public consultations, and social media engagement. The goal is to gather a wide range of viewpoints and understand the issues that matter most to these different groups.

- Incorporating Feedback: The feedback received from stakeholders is then analysed and used to inform the materiality assessment. This includes understanding their concerns, expectations, and perceptions of the company’s impact on social and environmental issues.

- Transparency and Reporting: Communicating the outcomes of the materiality assessment back to stakeholders is crucial. This transparency helps in building trust and demonstrates the company’s commitment to considering and acting on stakeholder input.

- Ongoing Engagement: Stakeholder engagement is not a one-off event but an ongoing process. Regular communication helps in keeping abreast of changing expectations and emerging issues, ensuring that the materiality assessment remains relevant and up-to-date.

For BWC, the way iGaming companies involve stakeholders in their materiality assessments is a key indicator of their commitment to transparency and social responsibility. It provides insight into how these companies understand and respond to the needs of their diverse stakeholder groups, which is crucial for our evaluation process.

Interpreting Materiality Matrices

Before we compare the materiality assessments of the MGA and various iGaming operators, it is essential to understand how to interpret the materiality matrices these organisations use to communicate their ESG priorities.

A materiality matrix is a visual tool that plots the significance of ESG issues against two dimensions:

- Importance to Stakeholders: This axis (often vertical) reflects how much value stakeholders place on different ESG issues. It captures the concerns and expectations of groups such as customers, employees, regulators, and the community.

- Impact on Business: The other axis measures the potential effect of ESG issues on the business. This includes considerations of risk, financial performance, and the company’s ability to operate effectively.

The matrix is typically divided into quadrants, which help to categorise the issues:

- The top-right quadrant represents issues that are highly important to stakeholders and have a high impact on the business. These are the issues that a company would prioritise for action and reporting.

- The bottom-right quadrant includes issues that are less important to stakeholders but still have a high impact on the business. These might be areas where the company has a significant operational interest.

- The top-left quadrant shows issues that are important to stakeholders but may have a lesser impact on the business. These can often be areas related to corporate citizenship and ethical conduct.

- The bottom-left quadrant is for issues that are currently of lower importance to stakeholders and lower impact on the business, which may be monitored for any changes over time.

Understanding the matrix allows us to discern which ESG issues are considered material by the organisation – that is, which issues warrant the most attention and resources. It’s a balancing act between stakeholder expectations and business strategy, and it’s a dynamic tool that can change as a company’s circumstances and the external environment evolve.

With this understanding of how to read a materiality matrix, we can now critically examine and compare the matrices of key players in the iGaming industry.

Examining Materiality Matrices: An Industry Comparison

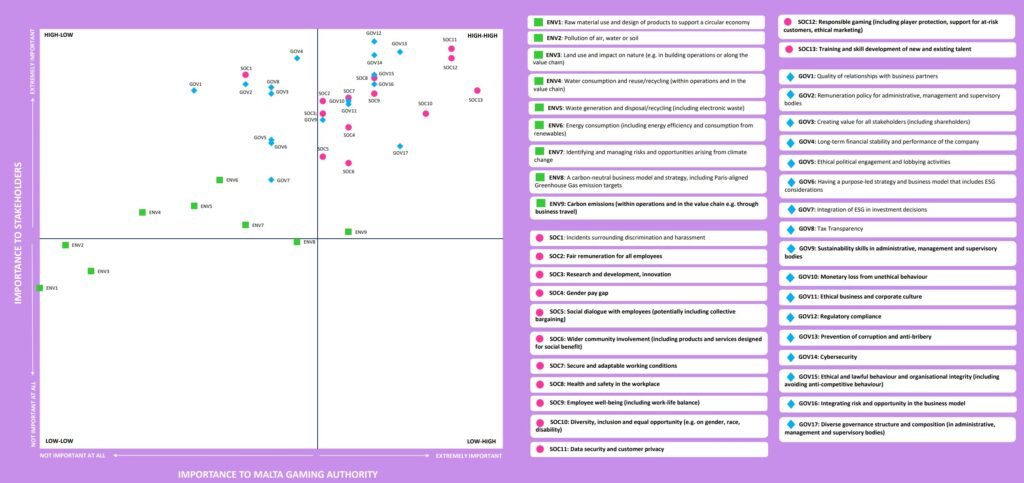

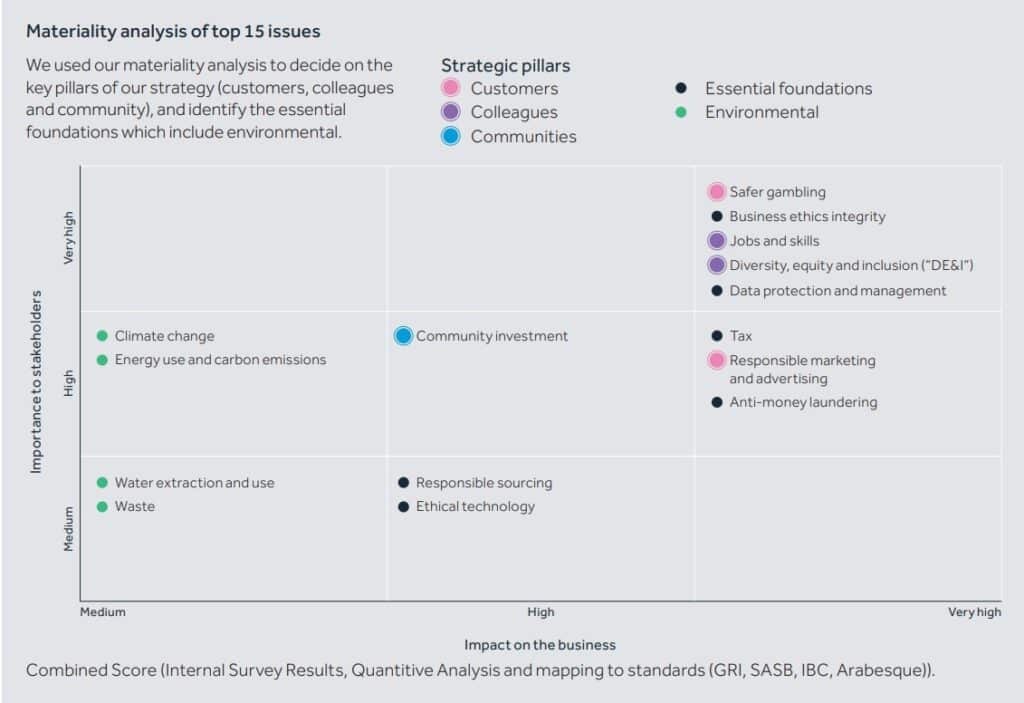

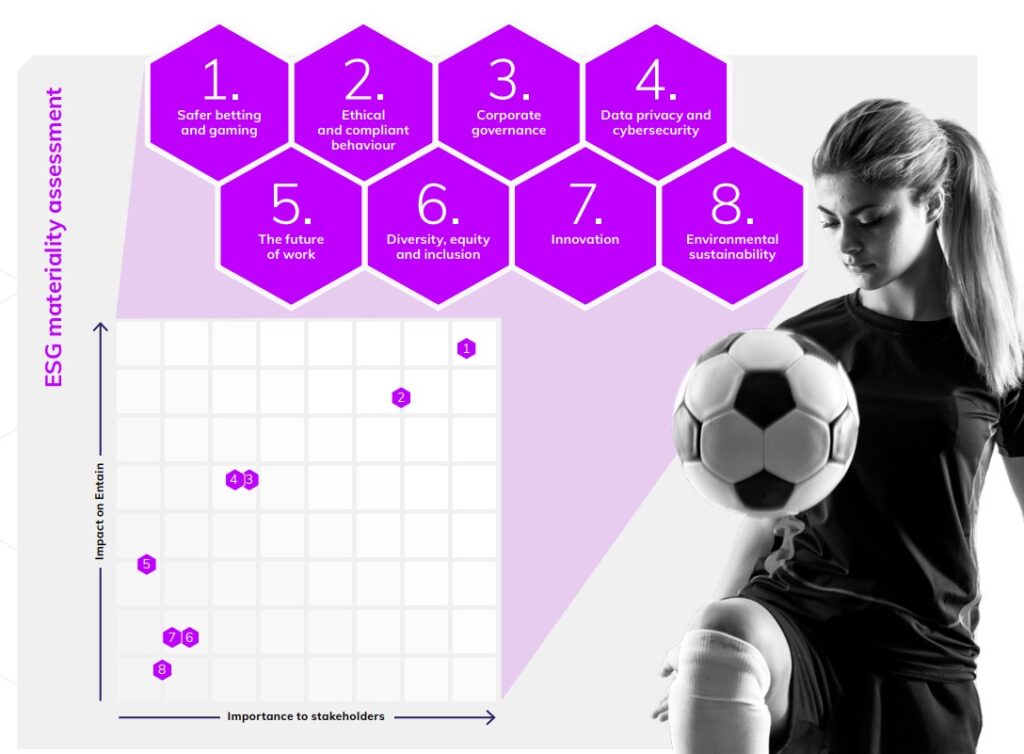

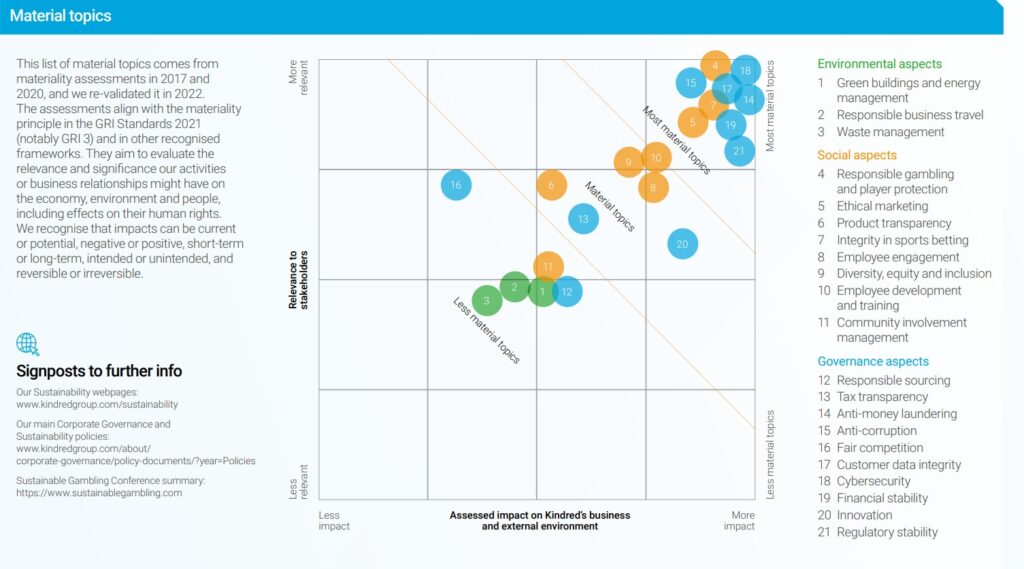

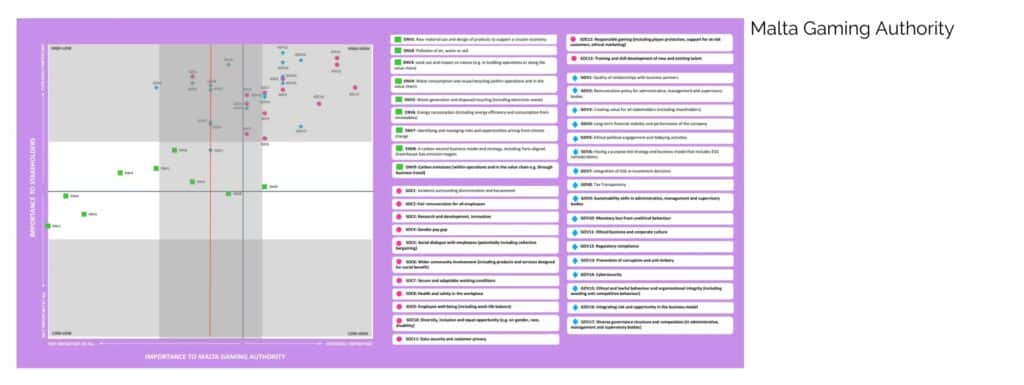

Now that we understand what a materiality assessment and materiality matrix are, let’s examine the materiality matrix of the Malta Gaming Authority (MGA) ESG code and compare it with those of the following brands:

- Aspire Global (read here our ESG review of Aspire Global)

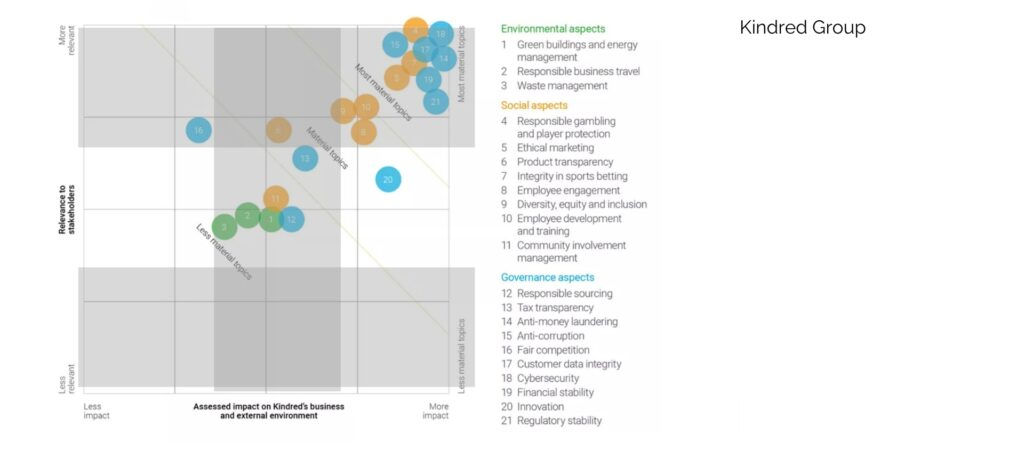

- Kindred (read here our ESG review of Kindred)

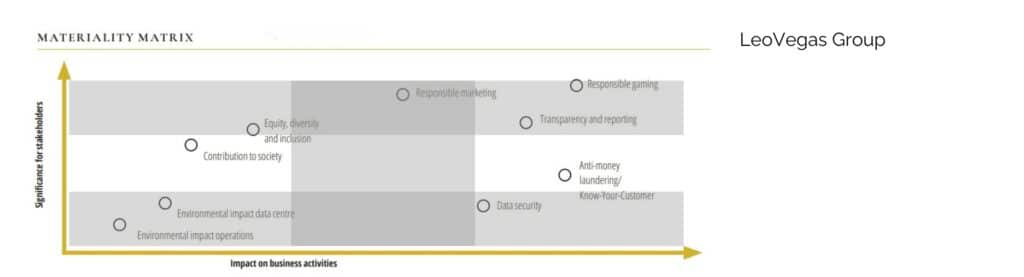

- LeoVegas Group (read here our ESG review of LeoVegas)

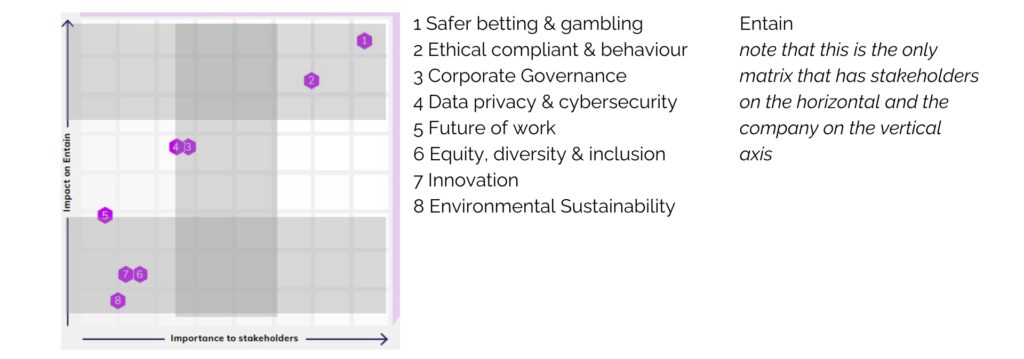

- Entain (read here our ESG review of Entain)

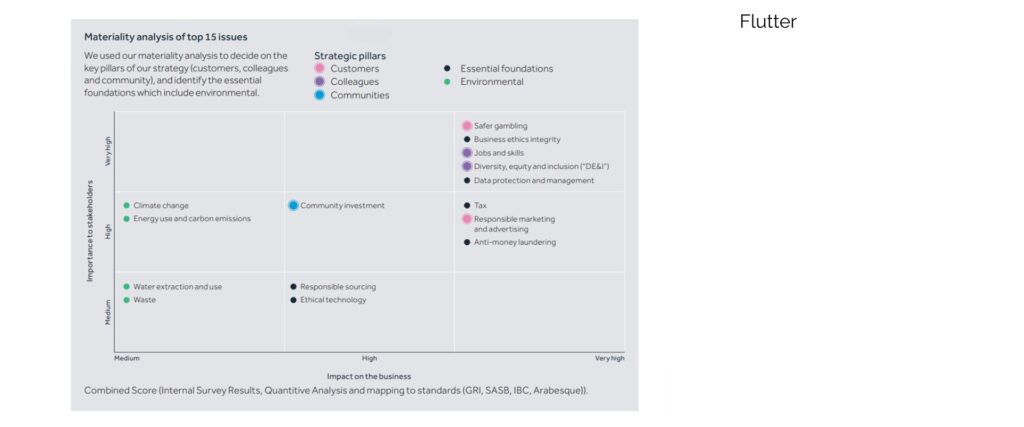

- Flutter (read here our ESG review of Flutter)

Our approach to this analysis encompassed the following steps:

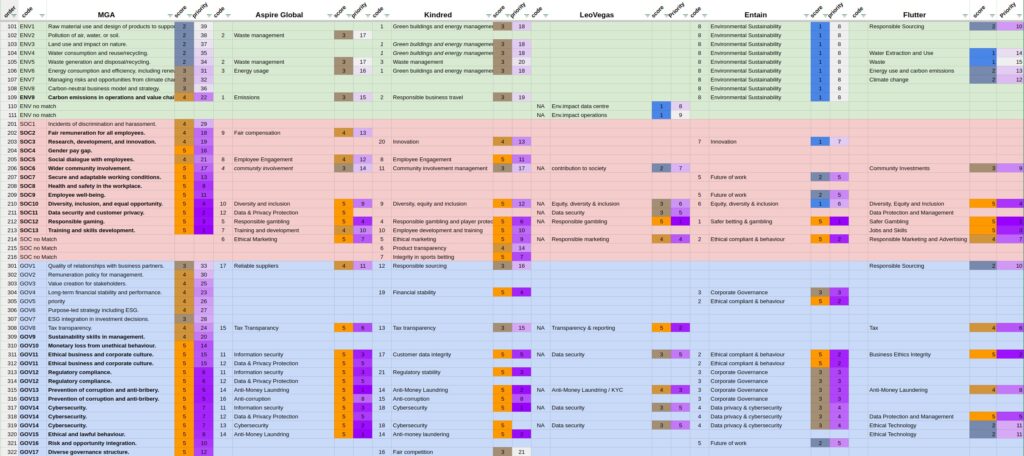

Inventory of all the topics covered by each operator and matched them with those identified by the MGA. You can see the outcome of this exercise in this sheet.

Each topic was scored on a scale from 1 to 5. I did this by dividing the matrix in a 3 by 3 grid and giving topics in the top right corner 5 points, the bottom left 1 point and the ones in between 2, 3 and 4 points. (see image below). You can see the score in the orange cells in the sheet.

Each topic in each operator’s matrix was accordingly ranked on priority, starting with the most important in the top-right (number 1) and numbering the rest from top to bottom, moving from right to left (2,3,4 etc). The priority scores are indicated in the purple cells in the sheet

Source material

The original materiality matrices can be seen as illustrations above in the post including a link to the source. Below you can see the matrices with an overlay to identify the different quadrants used for scoring the different topics.

Scope and limitations of the analysis:

- I have only looked at the matrices and have not considered any written content from the reports that might give additional explanations.

- A matrix is not representative of the amount of research and resources invested by the team that has conducted the research.

- The point of sharing my findings is to show that there is a significant differences. Not to judge any of the assessment or quality of the strategy conducted by the respective companies.

The key findings

In this sheet you can view the inventory and all the data gathered from the different materiality matrices (note that you can filter and sort data. Feel free to leave comments).

When comparing the six matrices the following stood out:

- There is a big difference in the detail and the amount of topics identified and presented by the different organisations. The MGA is the most detailed with 44 listed topics but with a notable omission namely the absence of ‘responsible-‘, or ‘ethical marketing’ which all operators list and rate as very important. While Entain and LeoVegas define merely 8 and 9 topics respectively. Flutter with 15 topics, Aspire Global with 17 topics and Kindred with 21 topics sit in the middle.

- Tax transparency is a subject that four out of the five operators included in their materiality assessment and they seem to give it higher priority than the MGA.

- All parties consider ‘safer gambling’ or ‘responsible gambling’ one of the top priorities, but not all of them rate it as the highest priority. Kindred and Aspire both rank information / cyber security and anti-money laundering higher.

- Environmental issues are deemed least material by all, which is understandable given the industry’s limited direct environmental impact. In our opinion, this area should not be overlooked due to the broader implications of environmental issues on consumer spending power and the supply chain’s reliance on raw materials and energy.

- Entain is the only one of these 6 matrices that puts the business on the vertical axis and stakeholders on the horizontal axis.

- LeoVegas has the least detailed list of identified topics but does define more detailed environmental topics by rating ‘environmental impact of data centres’ and ‘environmental impact of operations’ separately.

The language used to describe the matrices also varies significantly:

- The MGA labels its matrix axis from ‘not important at all’ to ‘extremely important’.

- Aspire Global uses a simple ‘low to high’ scale.

- Kindred delineates its matrix with ‘less impact’ vs ‘more impact’ horizontally and ‘less relevant’ vs ‘more relevant’ vertically.

- LeoVegas and Entain do not label the scale of their axes.

- Flutter employs ‘medium, high, very high’, notably omitting a ‘low’ category.

This might seem a minor thing but is of great importance for how information is perceived. A topic is viewed differently when labelled ‘not important at all’ or ‘low’ compared to labelling it ‘less relevant’, ‘less impact’, or ‘medium’.

What can we conclude from comparing the different materiality assessment matrices?

Reviewing and comparing the materiality assessments of different igaming companies has provided several insights. Again I want to acknowledge the limitations of the conducted analysis. As noted above I have merely looked at the visual representation of the different assessments. What stands out most is the significant differences in topics selected and how they are valued and prioritised by the different organisations.

It makes me wonder about what are the main causes of these differences and the following questions arise:

- Do the different organisations use very different methods?

- How would they compare looking at the amount of time, resources and expertise applied?

- If the same methods were applied and the same topics were used, would the matrices of each company also be so different?

- What do the differences say about each company? about their values, company culture, priorities and/or strategies?

- How would an analysis look if we first establish a common baseline with an assessment for each stakeholder group and overlay the company’s assessments on top? Could we see if some companies think more from the perspective of a player, or a regulator or shareholder?

My findings make it clear the complexity of ESG and how hard a task it is to compare companies on ESG performance as there are not only many variables and parameters but also ways to interpret and relate to them which influence how much priority we give to one topic over another.

Envisioning a Standard for Materiality Assessments in iGaming: BWC’s Perspective

Above mentioned conclusions strengthen the need for more uniformity. Better World Casinos (BWC) envisions a future where the iGaming industry embraces a standardised approach to materiality assessments, enhancing transparency and accountability across the board. We see the development of such a standard as a collaborative journey, one that requires the collective effort of the entire industry, from regulators to operators and stakeholders.

The Vision for Collaborative Engagement: BWC believes in the power of inclusive stakeholder engagement to develop a comprehensive ESG framework. We aim to be part of the driving force that brings together diverse perspectives, including those of players, industry experts, regulatory bodies, and advocacy groups, to establish a shared understanding of what constitutes material ESG issues within iGaming.

Benefits of Uniformity in ESG Reporting: A uniform set of ESG topics and a consistent scoring system would greatly benefit our work at BWC, providing a clear benchmark for evaluating the ethical and sustainability practices of iGaming companies. Although each entity may value different topics according to its unique context, a standard scoring system would facilitate meaningful comparisons and highlight industry-wide priorities.

Advocating for Industry-Wide Benchmarks: BWC advocates for the creation of benchmarks and encourages companies to not just meet but strive to exceed these benchmarks, fostering a culture of continuous improvement and endorsing a ‘race to the top’.

A Dynamic, Iterative Standard: We understand the importance of adaptability within such a standard to reflect the industry’s evolving nature. Therefore, we propose an approach that is both dynamic and iterative, ensuring the standard remains relevant over time by responding to new trends, insights, and stakeholder feedback.

BWC is committed to working alongside the iGaming industry to realise this vision. By pushing for a consensus on materiality assessments, we aim to contribute to a landscape where players can make informed choices and companies can showcase their commitment to ESG excellence. It’s a future that not only aligns with our values but also serves the greater goal of transforming iGaming into a force for positive impact.