Update: On december 17th 2023 the Malta Gaming Authority (MGA) provided commentary on BWC’s perspective on the MGA ESG code. This commentary has been included in the text below the relevant paragraph and accordingly the conclusion to the post has been updated.

Nestled in the heart of the Mediterranean, Malta has established itself as the iGaming capital of Europe, boasting a substantial presence with 10% of the world’s gaming companies. Malta was the first European country to regulate gambling in online casinos, a move that, coupled with its enticing tax incentives, English-speaking populace, and EU membership, has spurred remarkable growth in the sector.

The Malta Gaming Authority has stepped into the spotlight with the release of its ESG Code aimed at bolstering transparency and accountability within the industry. At Better World Casinos (BWC), these principles are not just buzzwords but the bedrock of our mission. However, the introduction of the ESG Code in the wake of Bill 55 raises both hopes and eyebrows.

This article will navigate the nuances of the ESG Code, offering a balanced commentary from BWC’s standpoint, highlighting the strengths, the areas of concern, and pondering the potential ripple effects across the industry’s future.

Who is the Malta Gaming Authority (MGA)?

The Malta Gaming Authority, founded in 2001, is the linchpin of Malta’s iGaming industry, a regulator with a storied past and a substantial influence. As the pioneering body that introduced the first comprehensive legal framework for online gaming within the EU, the MGA has been pivotal in Malta’s emergence as an iGaming powerhouse. Yet, it’s a regulator that finds itself at a crossroads, navigating the balance between fostering a flourishing industry and addressing the increasing calls for enhanced oversight.

What is ESG?

ESG stands for Environmental, Social, and Governance, three pillars increasingly recognized as crucial for sustainable business practices. ESG is sometimes used in different ways. Primarily, it’s a framework that evaluates an organisation’s performance across these dimensions, emphasising materiality — the varying levels of impact a business has on its environment, society, and the industry at large. In a world grappling with climate change, social inequality, and corporate malfeasance, ESG is sometimes also used in explaining a mentality which marks a pivotal shift. It’s about fostering business operations that consider long-term impacts on the planet and society, and not just immediate profits. ESG is as much about creating transparency and accountability in these areas as it is about measuring them.

The MGA ESG Code: An Overview

The MGA’s ESG Code presents itself as a voluntary framework, inviting gaming companies to align with its principles. It is not a set of rigid mandates, but rather a call to action for ethical and sustainable business practices within the industry. This code serves as a bridge between the high-octane world of gaming and the imperative of corporate responsibility, guiding companies towards operations that consider their long-term environmental, social, and governance impact.

The MGA ESG Code was developed to address the unique position and challenges of Malta’s remote gaming sector. Despite the sector’s significant role in Malta’s economy and global gaming market reputation, there was a notable lack of standardized ESG reporting among the over 340 licensees in Malta. This gap often led to inconsistent approaches to ESG topics and metrics, while ESG principles were sometimes viewed as an additional burden rather than integral to business operations.

The ESG Code aims to guide remote gaming companies in ESG reporting, providing a framework for standardized disclosures and helping to align practices with the increasing regulatory mandates, such as the upcoming Corporate Sustainability Reporting Directive (CSRD) requirements.

Read more about CSRD and it’s implications for iGaming business

This voluntary code serves to facilitate benchmarking within the industry, especially benefiting small and medium-sized entities (SMEs) in developing their ESG strategies. Ultimately, it helps these companies to demonstrate their commitment to ethical conduct, address industry-specific challenges like responsible gaming and data protection, and build trust and credibility with stakeholders

Intended Audience for the Code

Primarily directed at entities holding an MGA license, the ESG Code has been consciously designed to be as accessible and inclusive as possible. Its voluntary nature, the two-tier system, and the overlap with other ESG frameworks are strategic choices made to encourage maximum participation. By lowering the barriers to entry, the MGA aims to attract a broad range of participants from across the licensed gaming landscape. This inclusive approach is meant to extend the Code’s influence beyond mere regulatory compliance, ensuring that its benefits touch all stakeholders, including employees, customers, and society at large. In this spirit, the MGA is not merely setting a standard for legal adherence but is actively fostering a holistic approach to stakeholder welfare and ethical conduct.

Current ESG Reporting in the iGaming Industry

While the iGaming industry is not new to ESG reporting, with initiatives like the EGBA’s (European Gambling and Betting Association) annual Sustainability Report reflecting social responsibility progress, and the AGA’s (American Gaming Association) industry-wide ESG assessment indicating a shift towards more sustainable practices, there is still room for improvement. Examples of ESG reporting in the industry highlight both advancements and areas needing attention.

Gaps in ESG Reporting

The current landscape of ESG reporting in the iGaming industry shows several shortcomings:

- Varied Standards: There is no standardised approach to ESG reporting in iGaming.

- Voluntary Participation: ESG initiatives are not uniformly adopted across the industry.

- Limited Scope: Smaller entities may not report as comprehensively as larger organisations.

- Lack of Independent Verification: ESG reports often lack third-party verification.

- Governance and Tax Transparency: Reporting on governance and tax practices remains insufficient.

Acknowledging these gaps is crucial as we examine the MGA’s ESG Code and consider its potential to elevate industry standards.

Stakeholder Expectations

In an industry where reputation and trust are paramount, players and other stakeholders have clear expectations when it comes to ESG initiatives. The MGA specifically refers to a report by KPMG entitled ‘ESG scores points with Gaming Customers (published 2022). It mentions the following key points:

- Transparency: There’s a growing demand for clear and honest communication about how iGaming companies operate and contribute to societal goals.

- Accountability: Stakeholders expect companies to not only set ESG targets but also to report on their progress and hold themselves accountable for the results.

- Responsible Gaming: Players seek assurances that gaming companies are committed to promoting safe gambling practices and providing tools to help manage their play.

- Social Contribution: There’s an expectation that companies will actively contribute to social causes and community development, not just through direct contributions but also through responsible business practices.

- Environmental Responsibility: With climate change concerns on the rise, stakeholders are looking for iGaming companies to reduce their carbon footprint to zero and engage in sustainable practices, ideally aiming to become net positive.

These expectations set the stage for the MGA’s ESG Code, which aims to meet these demands through its voluntary guidelines. However, whether these guidelines will satisfy stakeholder expectations remains to be seen.

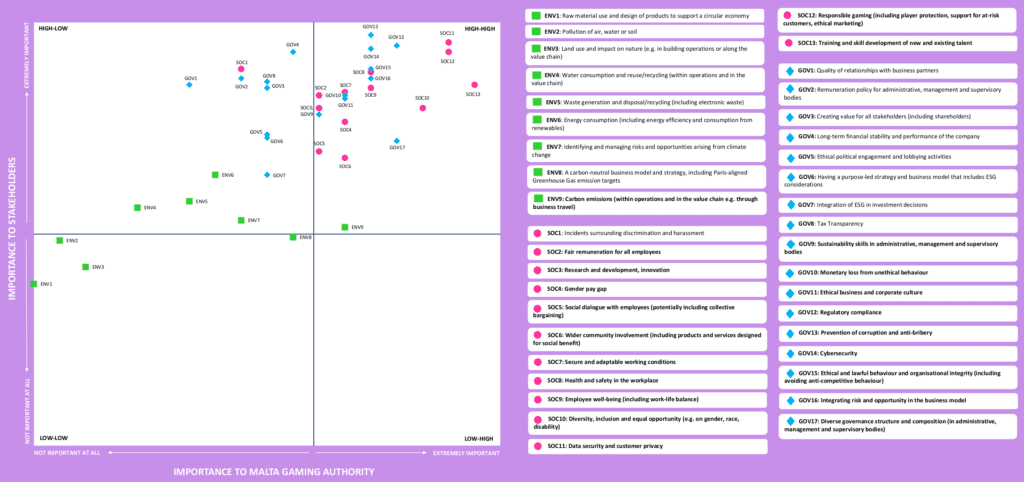

Materiality Matrix and ESG disclosure

A materiality matrix is a strategic tool used to identify and prioritize key topics based on their importance to an organization and its stakeholders. In the context of the MGA-ESG Code, the materiality matrix was created through a survey sent exclusively to all MGA license holders. Notably, this survey did not involve players, regulators, healthcare professionals, or other stakeholders.

Read more about materiality assessment en establishing an industry standard

The matrix is structured to display two dimensions of importance: on the horizontal axis, it shows the significance of various topics according to the Malta Gaming Authority (MGA), while the vertical axis represents the importance of these topics as perceived by the license holders, who are considered the ‘stakeholders’ in this context. This design allows for a visual representation of which ESG topics are prioritized both by the regulatory body and by the industry operators under its purview.

The research identified a total of 39 key topics, which were categorized into the three clusters: Environmental (E), Social (S), and Governance (G). Each cluster encompasses a range of topics, reflecting the diverse aspects and challenges pertinent to the respective categories. Based on the priority given to each topic they were plotted on a graph, see the below image.

From the 39 topics, 22 topics were selected for the ESG disclosure instructions. Of these topics 4 were deemed of highest importance, 8 of high importance and 16 of moderate importance. These are the topics in bold in the matrix above.

In the report can be found what needs to be reported on for each topic and for which tier disclosure is required, either Tier 1, Tier 2 or optional. For a company to be eligible for the seal of approval, it needs to report on these topics by the 3rd quarter of 2024.

BWC’s Perspective on the MGA ESG Code

Better World Casinos acknowledges the MGA’s ESG Code as a step towards integrating corporate responsibility into the iGaming industry which is a positive development. However, we hold a nuanced view, appreciating the initiative’s potential while also recognizing its limitations.

Stakeholders representation: The code repeatedly mentions stakeholders, in plural, while in reality it only considers the input of one stakeholder group (beside itself) namely the licence holders. Other stakeholders, such as players, regulators, employees, and the broader community have not been consulted hence giving a bias to what is considered important.

Commentary MGA dec.17 2023

In our approach to policy-making and initiative development, we prioritise the stakeholder group most significantly affected by a new policy or initiative. This inclusive approach extends to the general public and other stakeholder groups when a clear and tangible benefit can be derived from their consultation. Importantly, our decision to concentrate our consultation efforts specifically on licence holders stems from a thoughtful consideration of the unique context surrounding the Code.

Recognising that the Code is intricately tailored for the gambling sector and that the primary beneficiaries are the licence holders, we made a deliberate choice to focus the consultation predominantly on this critical group, ensuring that those most directly affected by the Code have a central role in shaping its development.

However, it is crucial to underscore that our commitment to inclusivity remains steadfast, and we have indeed engaged with other stakeholders. Although these engagements have been to a lesser extent, they encompass discussions with the local ESG platform and the Ministry for the Environment, Energy and Enterprise, amongst others.

Our peer review process delved into existing reporting frameworks and research, providing insights into industry practices and expectations in ESG reporting. As we continually review and improve the Code, our commitment is to broaden discussions with various stakeholder groups. We anticipate that as the Code becomes more established, clearer expectations of the Code will facilitate more focused and beneficial discussions with a broader range of stakeholders.

Materiality Matrix’s Bias: The current matrix puts the line dividing the ‘high-high’ quadrant from the ‘high-low’ quadrant more to to the right which gives the impression of the MGA giving more priority to what they find most important rather than what stakeholders find most important.

Commentary MGA dec.17 2023

The Code cannot be considered in isolation from other projects and initiatives that the Authority is involved in. Through ongoing outreach initiatives, direct contact with players seeking support, and engagement in diverse studies and research efforts, the Authority maintains a finger on the pulse of the industry. This approach allows for a comprehensive understanding of emerging trends and challenges, positioning the Authority to assess the evolving landscape and make informed decisions about what the Code should encompass to effectively represent the interests of all stakeholders. While the involvement of licensees was crucial to the process, it is essential to note that the Authority bears the ultimate responsibility for shaping the framework and ensuring it represents the collective views of other stakeholders.

In determining the ESG topics for the materiality assessment, we adopted a multifaceted approach, drawing insights from research, peer review, and consultative discussions with licensees. This method ensured a comprehensive understanding of industry practices and expectations, fostering a balanced selection of topics. The goal of the materiality assessment was to maintain a balanced and manageable framework while considering the impact on society, financial implications, existing reporting requirements, the strategic importance to Malta or the Authority, and ease of implementation.

As we move forward, ongoing revisions of the Code will incorporate additional ESG topics identified in this collaborative and consultative process, reinforcing the commitment to a balanced and responsive regulatory approach.

Selective Focus in Materiality: The materiality matrix within the Code indicates a selective focus on certain ESG aspects and overlooks other critical areas such as broader environmental impacts and comprehensive governance issues. Such selective emphasis may not fully capture the range of stakeholder concerns, potentially leading to a skewed implementation of ESG principles.

Commentary of MGA dec.17 2023

As explained above, the long list of topics identified for the materiality assessment results from a thorough process involving research, peer review, and in-depth discussions with our licensees. While we acknowledge the significance of incorporating additional disclosures, it is imperative to underscore our concerted efforts to strike a delicate balance in formulating a reporting framework that is both comprehensive and manageable.

Our objective has been to foster a standardised reporting approach within the gambling sector, laying the foundation for benchmarking between companies, establishing common goals in ESG, and providing a transparent and clear overview of the sector. This initiative seeks to encourage widespread participation, ensuring the success of the framework.

In our future revisions of the Code, we commit to expanding the scope of our materiality considerations and reassess whether any further disclosures are required.

Need for Comprehensive ESG Integration: A comprehensive ESG strategy should not just be about ticking boxes but about embedding these values into the core of business operations, setting goals and implementing measures for tracking and reporting on progress. The code lacks goal setting and progress tracking and seems to reduce ESG merely to a reporting exercise.

Commentary MGA dec.17 2023

The Code is a reporting framework that aims to incentivise companies to formulate their own strategy, or align it with the requirements of the Code, specifically developed for the gambling sector. The Code aims to facilitate the benchmarking, and progress can be measured over time, not only for participating companies but for the industry as a whole.

Our initial decision in the developmental stage aimed to make the Code more accessible to the wider industry; hence the emphasis on reporting rather than setting ESG targets. Given that the gambling sector is not widely accustomed to establishing ESG targets, especially among smaller and medium-sized companies, reporting serves as a foundational step. Ambitions may be integrated at a later stage as the Code gains wider adoption and sufficient data becomes available for benchmarking.

ESG code approval seal: the MGA’s plan to issue an ESG code approval seal to compliant companies raises concerns. While this seal could incentivize adoption and adherence to the Code, there is also a risk of it being perceived as a blanket endorsement, potentially leading to greenwashing and social washing. BWC emphasises the need for clear communication to the public about the limitations and the actual scope of the Code to prevent misconceptions.

Commentary MGA dec.17 2023

The introduction of the ESG code approval seal adds an incentive for voluntary participation. We believe that having a well-designed framework with clear requirements and guidelines for the sector reduces greenwashing.

We remain transparent about the criteria for obtaining the approval seal, emphasising clear communication to prevent both greenwashing and social washing.

Tax and Financial Transparency: The lack of any emphasis on financial and tax transparency is troubling for BWC. Given the iGaming industry’s complex financial dealings, we believe that robust tax transparency should be a cornerstone of any sincere ESG commitment. It’s essential for fostering trust and integrity within the industry. It’s also noteworthy, as mentioned in the previous paragraph, that the stakeholder finds these topics more important than the MGA.

Commentary MGA dec.17 2023

Our primary focus was on gambling-related aspects, and the emphasis was placed on such considerations, aligning with our role as a regulator of the sector. Recognising the importance of tax and financial transparency in ESG reporting, we will duly consider these aspects in future Code review cycles. Our initial focus was on ensuring relevance and balance, and as we continue to refine the Code, broader considerations will be incorporated.

Read more about tax transparency

Conclusion: Embracing ESG for a Sustainable Gaming Future

The introduction of the MGA ESG Code is a significant moment for the iGaming industry, signalling an increased recognition of the importance of sustainable and ethical practices. For Better World Casinos, the MGA’s ESG Code is both an opportunity and a challenge. It presents a chance to promote a more holistic ESG approach, one that covers a wider spectrum of issues, including those not thoroughly addressed in the current framework. The challenge lies in ensuring that the adoption of ESG principles goes beyond mere compliance, evolving into a transformative process that reshapes the industry’s ethos.

Upon publication of this post we have reached out to the MGA and they have taken notice of our review and provided us with commentary on our findings which have been included in this post on the 20th of december 2023 (see fold down sections ‘Commentary MGA dec. 17 2023’).

It is clear that we have different opinions which is expected. When it comes to the stakeholder representation we like to note that we hold a different view and definition of the purpose of ESG and a code.

Yes, the code needs to be implemented and adhered to by the licence holder so they are the primary stakeholder. But the need for the code is because there is an impact on the society and environment. The code is not for the industry, the code is to create a roadmap to contribute to a more sustainable world. It’s a means to an end. In BWC opinion all other external stakeholders are just as important.

With regards to Tax & financial transparency they say they focus on relevance and balance of ‘gambling related aspect’, but obviously this is very subjective. How is determined, for example, whether ‘carbon emissions’, ‘gender pay gap’ and ‘sustainable skill in administrative, management and supervisory bodies’, which the MGA does include, are more of a ‘gambling related aspects’ than ‘tax transparency’?

On the other points we can agree that due to the nature of it being the first version, we will need to see how the code evolves based on it’s adoption and implementation by the license holders and if we can see improvement in performance in the following years.

BWC is committed to utilising investigative journalism as a tool to analyse, scrutinise, and hold iGaming businesses accountable. By influencing public opinion and shining a light on company actions, we aim to ensure that the industry adheres not just to the letter, but also to the spirit of ESG principles. Our focus is broad, encompassing all ethical aspects of ESG, from responsible gaming to fair business practices.

Our vision extends to the creation of an industry-wide, globally applicable ESG framework. Such a framework would not only align with, but also surpass, the standards set by initiatives like the MGA ESG Code. It would take into account the entire range of environmental, social, and governance impacts.

Moving forward, Better World Casinos (BWC) will engage with stakeholders across the industry and leveraging the data provided by the mandatory reporting under the Corporate Sustainability Reporting Directive (CSRD). We aim to guide the iGaming industry towards a future where responsible, transparent, and ethical practices are standard.

The path towards a sustainable gaming future is a collective journey, and BWC is leading the charge for a more responsible and accountable iGaming industry.

References

To learn the full story of BWC, read: Make the world better while you play > About us and the goal > How we rate > Casino Reviews > Join us > more in our Blog